Just How an Offshore Trust Can Boost Your Financial Protection and Estate Management

If you're seeking to boost your monetary safety and security and simplify your estate administration, an offshore Trust could be the option you require. By putting your assets outside your home country, you can safeguard them from financial institutions and political dangers while ensuring your dreams are recognized after your passing. What exactly are the benefits of such a trust, and exactly how can it fit into your financial approach? Let's explore this even more.

Understanding Offshore Trusts: A Primer

The Legal Framework of Offshore Trusts

When establishing up an overseas Trust, it's important to understand the legal framework that regulates it. You'll need to contemplate laws, jurisdiction options, and the tax obligation ramifications that come right into play. Each of these elements can substantially affect the effectiveness and protection of your Trust.

Offshore Trust Regulations

Offshore Trust laws develop a complicated legal structure designed to secure possessions and offer financial protection for family members and people. These guidelines differ by jurisdiction, however they normally require openness and conformity with anti-money laundering laws. When establishing up an offshore Trust, you'll need to select a respectable trustee who sticks to both local and worldwide guidelines. It's vital to comprehend the coverage demands enforced by tax authorities in your house country, as failing to conform can cause penalties. Additionally, you need to know the implications of your estate planning decisions, as these can greatly influence your economic security. By maneuvering through these laws carefully, you can optimize the benefits of your overseas Trust.

Territory Considerations

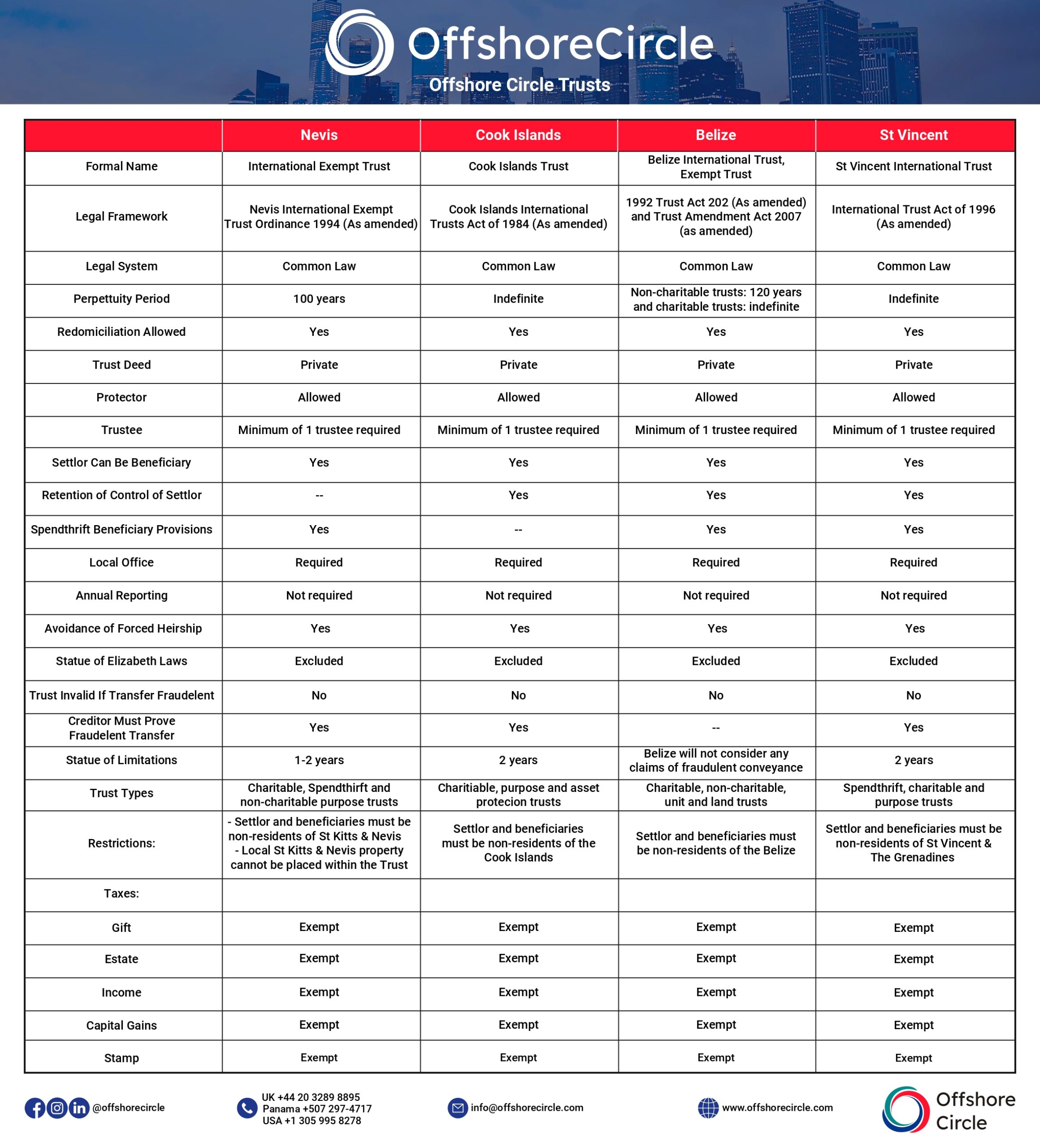

Choosing the ideal jurisdiction for your offshore Trust is vital in guaranteeing its effectiveness and safety. Each jurisdiction provides distinct regulations and guidelines that affect exactly how your Trust runs. You'll intend to review asset security, personal privacy legislations, and the legal framework governing counts on in potential locations. Some territories are a lot more desirable to trustees and beneficiaries, giving a stable setting for your possessions. In addition, the credibility of the jurisdiction can influence your Trust's reputation and your comfort. Investigating the neighborhood legal landscape is crucial; seek advice from lawful specialists to discover a territory that aligns with your financial objectives and provides the most effective protection for your properties. An appropriate jurisdiction can significantly enhance your Trust's total success.

Tax Ramifications and Advantages

Benefits of Developing an Offshore Trust

Developing an offshore Trust can offer you considerable advantages, including robust asset defense approaches that shield your wealth from potential risks. You'll also appreciate tax efficiency benefits that can boost your overall monetary situation. And also, the personal privacy and privacy of offshore depends on maintain your individual info protect from spying eyes.

Asset Defense Techniques

An overseas Trust can give unequaled possession security when it comes to securing your wide range. By positioning your assets in a trust fund, you efficiently separate them from your personal estate, making it harder for financial institutions or litigants to declare them. This layer of security can be vital in today's litigious environment.Additionally, offshore depends on typically include durable privacy laws that secure your monetary info from spying eyes. If you're worried about potential suits or cases against your properties, developing an offshore Trust allows you keep control while lessening risk. It's an aggressive technique that not only protects your wide range yet additionally assures that your beneficiaries receive their inheritance without unnecessary problems. Shield what you have actually functioned hard for with this tactical financial tool.

Tax Obligation Efficiency Benefits

Offshore counts on not only supply durable possession defense however additionally present substantial tax performance advantages. By developing an offshore Trust, you can possibly minimize your tax responsibilities. Several jurisdictions offer beneficial tax obligation prices, enabling your assets to grow without the heavy worries of taxes. You might additionally gain from funding gains and income tax obligation exceptions, depending upon the particular legislations of the offshore location. Additionally, these trusts can assist you handle your estate much more efficiently, as they usually enable for tax-deferral opportunities. This means you can preserve even more of your wide range for future generations. Eventually, an overseas Trust can maximize your economic strategy, making sure that you keep even more of what you earn while boosting your general financial safety and security.

Privacy and Privacy

While you focus on constructing your discretion, personal privacy and wide range become important facets of your economic method. Developing an offshore Trust uses a durable layer of defense for your possessions, securing them from possible lenders and spying special info eyes. With this configuration, your monetary information continues to be private, allowing you to keep control without public scrutiny.Additionally, offshore trusts are usually governed by regulations that prioritize discretion, ensuring that your economic affairs avoid of the reach of undesirable attention. This privacy can greatly reduce the risk of identification burglary and various other economic risks. By leveraging an offshore Trust, you not only improve your economic security but additionally produce a protected environment where your wealth can grow without unneeded exposure.

Asset Security: Protecting Your Wide range

Possession defense is vital for anybody aiming to shield their riches from unpredicted risks and obligations. By developing an overseas Trust, you produce a lawful obstacle that can safeguard your assets from lawsuits, lenders, and prospective cases. Unlike domestic depends on, offshore trust funds typically supply more powerful protections due to beneficial lawful structures in particular jurisdictions.When you position your assets in an offshore Trust, you transfer legal ownership, making it challenging for lenders to get to those properties. This approach can be particularly advantageous for entrepreneurs and high-net-worth individuals that encounter greater risks.Moreover, with an overseas Trust, you keep control over your properties while enjoying enhanced safety and security. You can designate a trustee to manage your riches according to your desires, ensuring it's safeguarded against potential risks. Ultimately, an offshore Trust offers as an effective device to assist you protect your monetary future and maintain assurance.

Tax Advantages of Offshore Trusts

The tax advantages linked with overseas counts on can be a considerable draw when you consider the economic advantages of counts on. These counts on typically allow you to defer tax obligations on earnings generated within the Trust up until you choose article to withdraw it. This can lead to significant tax savings, as your financial investments can expand without being strained annually.Additionally, numerous overseas jurisdictions offer desirable tax rates or perhaps tax exceptions for sure kinds of earnings, which can further improve your financial placement. By placing your properties in an offshore Trust, you may additionally minimize your inheritance tax obligation, depending on your residency and the Trust's location.Moreover, overseas counts on can aid you prevent particular domestic tax obligations, making them an appealing alternative for high-net-worth individuals. By leveraging these tax advantages, you can effectively expand and safeguard your wide range, offering a strong foundation for your monetary future.

Streamlining Estate Management With Offshore Trusts

Offshore depends on not just offer considerable tax obligation advantages however likewise streamline estate management, making them an appealing alternative for individuals planning their tradition. By positioning your assets in an offshore Trust, you get a streamlined strategy to managing your estate. You can designate beneficiaries conveniently, ensuring that your desires are brought out without the extensive probate process.Additionally, overseas trusts offer privacy, securing your estate from public analysis and potential disputes among heirs. You'll have the versatility to structure your Trust according to your particular requirements, enabling tailored circulation strategies that adjust to changing circumstances.With professional trustees typically managing the management tasks, you can concentrate on what genuinely matters-- your household and your tradition. This peace of mind comes from knowing that your estate is organized, secure, and managed in line with your intentions, providing a smoother development for your enjoyed ones when the moment comes.

Selecting the Right Offshore Jurisdiction for Your Trust

How do you identify the most effective offshore territory for your Trust? Begin by considering elements like legal security, tax obligation benefits, and privacy laws. You want a territory with a strong legal framework that protects your assets and supplies positive tax treatment. Seek nations known for their solid privacy policies to keep your economic matters private.Next, think of access and the track record of the jurisdiction. Some locations may have a credibility for being governmental or excessively complex, which can prevent your Trust's performance. Research study the local regulations governing counts on and confirm they straighten with your goals.Lastly, seek advice from specialists who focus on offshore counts on. They can assist you browse the intricacies of different jurisdictions and advise the finest fit for your certain requirements. By considering these factors, you can select an overseas jurisdiction that boosts your financial protection and simplifies estate administration.

Frequently Asked Concerns

Can I Adjustment the Terms of My Offshore Trust Later On?

Yes, you can transform the terms of your offshore Trust later on, depending on its structure and stipulations. Simply consult your legal consultant to assure you follow the required treatments and abide with appropriate legislations.

That Can Be the Trustee of My Offshore Trust?

You can choose an individual or a business entity as your overseas Trust's trustee. Simply see to it they comprehend your objectives and can take care of the Trust effectively, keeping your finest passions in mind throughout the process.

What Are the Costs Included in Establishing up an Offshore Trust?

Establishing an overseas Trust entails numerous costs, including legal costs, management expenditures, and potential tax ramifications (offshore trust). You'll wish to budget plan for these variables to assure a smooth facility and ongoing management of your Trust

How Do I Guarantee Privacy With My Offshore Trust?

To guarantee personal privacy with your overseas Trust, you need to pick a credible territory, deal with knowledgeable experts, and preserve privacy with proper documentation. Frequently examine your Trust's structure to protect your financial information properly.

Can I Make Use Of an Offshore Trust for Company Assets?

Yes, you can use an overseas Trust for business assets. It aids shield your possessions from lenders, provides personal privacy, and can enhance management versatility, ensuring your company passions are safeguarded in a protected setting. Unlike residential trust funds, offshore trust funds commonly provide stronger defenses due to beneficial lawful frameworks in certain jurisdictions.When you put your assets in an overseas Trust, you move legal possession, making it challenging for financial institutions to reach those properties. When you think about the financial benefits of trusts, the tax benefits connected with overseas counts on can be a significant draw. These depends on often enable you to defer tax obligations on revenue produced within the Trust until you select to withdraw it. click now By positioning your assets in an overseas Trust, you may likewise lower your estate tax responsibility, depending on your residency and the Trust's location.Moreover, offshore depends on can help you prevent particular residential taxes, making them an attractive alternative for high-net-worth individuals. Research study the regional regulations governing depends on and validate they align with your goals.Lastly, consult with experts that specialize in overseas trusts.